Retired U.S. Foreign Service officer Bill Cook lost his home in Paradise, Calif., during the Camp Fire, the 2018 blaze sparked by Pacific Gas & Electric Company equipment that ranks as the deadliest and most destructive fire in state history.

Two and a half years later, Cook, 70, and his family are barely scraping by. Like Cook, the vast majority of the 67,000 PG&E fire victims included in a December 2019 settlement with the company have yet to see a dime. That's as lawyers and administrators have been paid millions, with the money coming directly from funds set aside to help survivors like Cook.

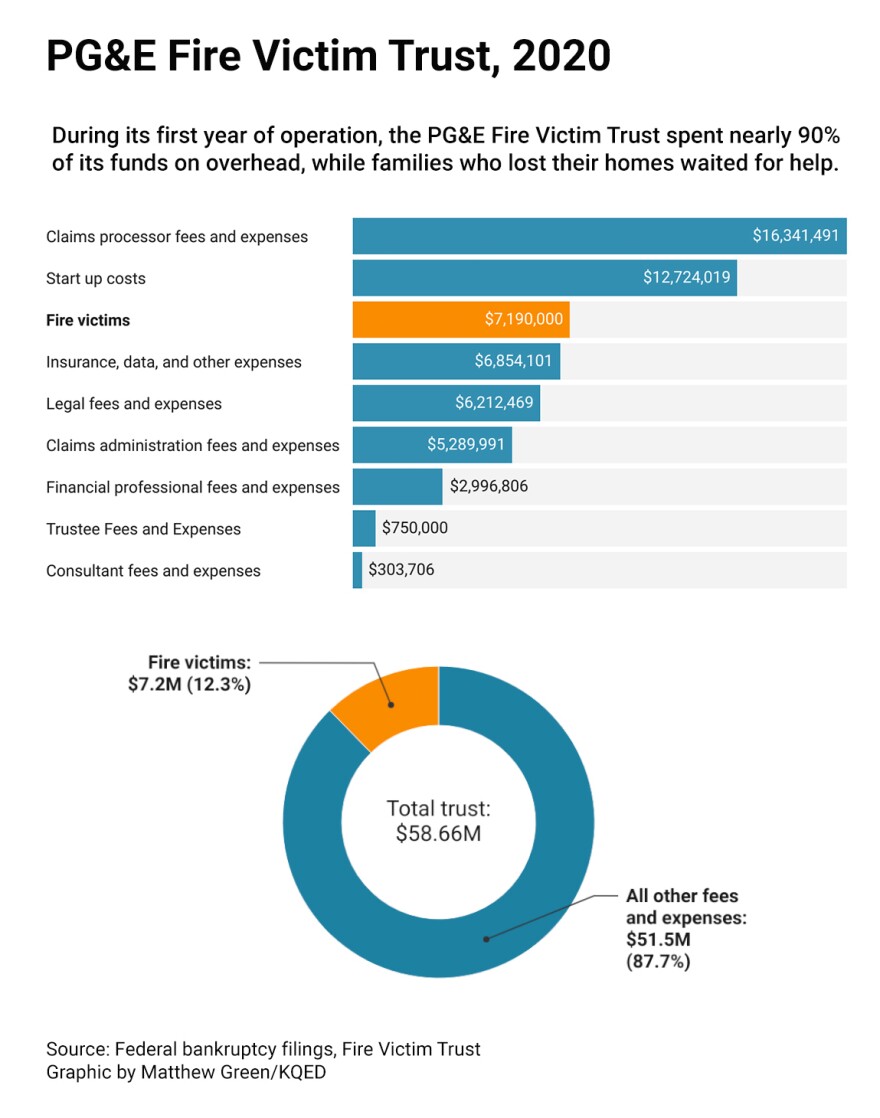

An investigation by member station KQED found that while survivors waited, a special Fire Victim Trust in charge of compensating them racked up $51 million in overhead costs last year. During that same period, the Trust disbursed just $7 million to fire victims — less than 0.1% of the $13.5 billion promised — according to an analysis of federal bankruptcy court filings, court transcripts, and correspondence between staff of the Fire Victim Trust and the victims themselves.

During its first year of operation, the Trust spent nearly 90% of its funds on overhead, while fire victims waited for help, KQED found.

Today, Cook lives 100 miles away from Paradise in Davis, where he shares a 3-bedroom rental with his 68-year-old wife, Leslie, four of their adult children and three grandchildren. He's eaten into his savings to pay rent, which costs triple what he paid for his mortgage in Paradise.

"You're stuck," Cook says. "You can't go anywhere. You can't get anything. You can't move forward."

Representatives for the Fire Victim Trust declined to be interviewed for this story. In a video message, released May 17, after KQED published its investigation, Trustee John Trotter says the pace of payments had ticked up in recent months. He acknowledges the fire victims' frustration, adding "we're doing the best we can."

Members of Congress from both parties view the situation differently. In separate emails, Rep. Mike Thompson, a Democrat, and Doug LaMalfa, a Republican both called for faster payouts. James Gallagher, a state Assemblyman who represents Paradise, says KQED's investigation "raises a lot of questions and concerns that need answers" and is calling for California Gov. Gavin Newsom to get involved. Through a spokesperson, Newsom declined to comment.

An annual report filed in federal bankruptcy court last week by its Trustee, John Trotter, reported $38.7 million spent on financial professionals, claims administrators, consultants and other operating expenses between July 1 and the end of the 2020. Documents reviewed by KQED show the Trust took in an additional $12.7 million in funding provided by PG&E last spring, cash spent to set up the claims process.

Trotter, a retired California Appeals Court Judge, has charged $1,500 per hour, according to another court filing, while claims administrator Cathy Yanni billed $1,250 per hour. In November, Yanni told KQED she expected it would take two years to pay all victims who have claims. Some fire survivors fear it will take much longer. The longer it takes, the higher the cost of administrative overhead will be.

Questions from the start

PG&E announced it plans to enter Chapter 11 bankruptcy protection in January 2019, ten weeks after its equipment sparked the Camp Fire, which killed at least 85 people and destroyed almost 19,000 homes and businesses in and around Paradise. The settlement with tens of thousands of fire victims resulted from those proceedings.

There were concerns about overhead expenses as early as last Spring, when U.S. Bankruptcy Judge Dennis Montali mulled whether to approve startup costs for the Fire Victim Trust.

"Tell me why I shouldn't think this is just a risk to have a very large amount of money be paid out without any kind of control over what happens," Montali said at a hearing last April. Attorneys representing fire victims pleaded with Montali to approve Trotter's appointment. Minutes later, Montali relented.

Montali was encouraged to greenlight the overhead by some of fire victims' own attorneys.

Gerald Singleton, an attorney who represents 6,500 fire victims and sits on the Fire Victim Trust Oversight Committee's budget subcommittee, says he's not concerned about the Trust's overhead. "When you're talking about what they have to do, I certainly think the money is reasonable," he says.

Payments to victims may have trickled out slowly. But Singleton says, the pace is picking up.

The process has been complicated by the terms of PG&E's settlement with fire victims, which is funded half with cash and half with PG&E stock. The complicated arrangement, which has few precedents, made the fire victims major shareholders in the utility and made administering the Trust far more complicated.

As of May 19, the most recent data provided to KQED by a spokesperson, the Trust had increased its payments to families this year and had now put $255.4 million into the hands of those who lost loved ones, homes and businesses lost to fires caused by PG&E.

That amount still comes to less than 2% of the amount promised to families when they voted on the settlement last year. The spokesman also said the Trust had been making partial payments to a small percentage of families. Those partial payments, which average approximately $13,000, have gone to 10,500 of the nearly 70,000 eligible families, a spokesperson for the Trust said.

Only 565 families had their claims fully processed, the Trust said. Those families are getting 30% of what they're owed, the Trust said. Meanwhile, the Trust collects its own fees in full.

Falling short by design?

As PG&E approached the end of its bankruptcy last year, Singleton and several other mass tort attorneys were busy persuading their fire victim clients to vote in favor of the complicated settlement involving part stock and park cash. Some fire survivors wrote to Judge Montali expressing outrage at the idea of accepting stock in the company that had harmed them.

Because of the stock component, the value of the trust fluctuates every day. So far, the Fire Victim Trust's financial advisors haven't liquidated any shares as the stock price has languished. Today, the trust holds almost a quarter of all PG&E shares.

In his video message to fire victims, Trotter says complications could lead to more delays. "The Trust didn't create the settlement," he says. "We're still walking uphill on this. We're not near the top yet," adding that "when we get to the top and down the other side it will go much more quickly."

But for many fire victims that's not good enough. "Families are still living in cars, travel trailers and FEMA trailers," Kirk Trostle, a retired police chief who lost his home in Paradise in 2018, wrote to Judge Montali, citing KQED's reporting.

"Stating fire victims are languishing is an understatement," he added. "I request you speed up the process to a sprint-like manner and direct the [Fire Victim Trust] to provide transparency and accountability in the administration of the fire victims' money."

Copyright 2021 KQED