KMUW's Carla Eckels recently talked to Kansas Insurance Commissioner Sandy Praeger about how the Affordable Care Act is going to affect people in Kansas and what to expect when the health insurance marketplace opens on October 1. Learn more about the basics of the marketplace here.

1. I’ve been asking people about the Affordable Care Act, or Obamacare, and so many people don’t know much about it. They’re a bit confused, not knowing what to expect. Can you give us an overview?

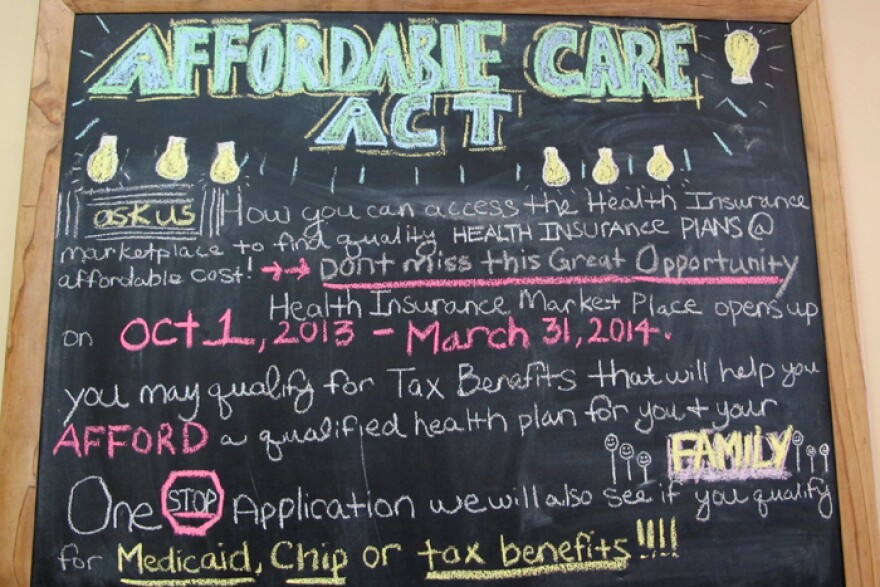

Sandy Praeger?: October 1, it will be the official opening of these new marketplaces and it’s a place, an Internet-based place for people to go and find out about health insurance and what might be available for them in Kansas.

This is not going to be a state exchange as it will be available in 17 states. Kansas opted out of running our own exchange, so it will be a federally run marketplace, but shouldn’t function much differently than the ones that are independent in the states. You’ll be able to compare, side by side, various plan options with different levels of co-pays and out of pocket expense. You’ll be able to enter your zip code and your total family annual income and then it will tell you whether or not you’re eligible for some form of a tax credit. So it will tell you what the premium will be for the plan you choose it will apply the tax credit and then tell you what your actual monthly cost would be.

2. Who is eligible to purchase insurance?

SP: The eligibility is for individuals and small groups through this exchange. Small group is employer groups of 50 or fewer employees.

3. How do you determine what plan is best for your family?

SP: Well, you look at the benefits. There are four levels of costs sharings. We call this the precious metals levels: the bronze, the silver, the gold and the platinum. And the bronze level, your premium pays for 60 percent from an actuarial stand point of the healthcare services you might use and 40 percent is out of pocket. So it goes up 10 percent. The silver is 70/30, the gold is 80/20, and the platinum is 90/10. Someone who’s relatively healthy thinks they’re not going to need a lot in the way of healthcare services. They say, "Well, I’m willing to take a chance on paying a higher percentage out of pocket." So they’ll go for the lower premium. Someone who anticipates they’re going to need healthcare services might go for that higher level, the platinum plan which is 90/10. That means the premium is going to be more. So everyone’s health situation potentially is a little bit different, although you know we can’t anticipate when we’re going to have appendicitis, be diagnosed with some sort of a cancer. So in a sense you’re just saying, "I’m willing to assume that additional financial responsibility, should that happen."

Another important provision in the law is that you cannot be denied coverage or charged more based on your health status. There are only four categories that you can be rated on and charged more and one is age. Family composition, obviously a single person versus a family with children would pay more. Geography, which recognizes that health care costs can be greater in some parts of the state versus others and then tobacco use. You can be charged 50 percent more for tobacco use.

4. When people sit down at the computer and try to apply for health insurance what are some of the items they’ll need to have?

SP: They need to have with them social security number. That’s going to verify that they are a legal citizen or if there is documentation that demonstrates they’re in the county legally and a legal resident. People who are not here legally are not eligible to purchase on the exchange. Some sort of a verification of what your income is, that’s the most important, and then where you live. Then what the computer will do is send that information to a data hub housed in Washington, which is supposed to—now we’re all going to be waiting to see if this all works as they say it’s supposed to. That data hub will then verify you are a legal resident, that’s through homeland security, and then it will verify your income through the IRS. And that is then how the tax credit is calculated and it will then feed back to you what your premium would be based on where you live and your family composition and then what your potential tax credit could be.

5. Who benefits most from the Affordable Care Act?

SP: People who’ve never been able to afford insurance, people who’ve had pre-existing conditions are now able to go out and buy affordable coverage because they cannot be denied coverage or told that the premium is just going to be exorbitantly expensive.

So let’s say you’re a bright person and you’ve got a great idea for a start-up company but you’re locked into where you work because of your employer-based coverage because your wife had breast cancer or you’ve had a heart attack.

You can’t afford to leave that employer and go out on your own because of those pre-existing conditions. That’s the old system. Now that entrepreneur who feels a little bit trapped in their job because the need to have health insurance for themselves and their family would have an opportunity.

So the important thing is that people have the means to pay for their health care services so the rest of us will benefit. Those of us who’ve had health insurance for many years have seen our premiums increase, as more and more people are uninsured because those people still go to emergency rooms. They still get treated and they go to doctor’s offices and they still get treated. They can’t pay for their care and insurance companies estimate that 25 to 30 percent of our premium is going toward helping to pay for that care that people receive that they can’t pay for. So if we can get people covered, we kind of get rid of that hidden tax that’s been there for a long time.

6. Will the new law change anything if you already have health insurance through your employer?

SP: It possibly will not change anything. Your employers can still provide health insurance for their employees the way they have been. The essential health benefits in Kansas were based on the small-group plan that had the largest number of enrollees in Kansas. So in most cases, the benefits that have been provided are not going to change.

If a company’s been providing just bare bones policies, they’re going to need to increase their benefits to comply with the federal law. But if they don’t want to make any changes and they don’t change the amount the employer/employees has to pay in terms of premium or increasing co-pays and deductibles, if they make no changes in their policies, then those policies are grandfathered and don’t have to comply with any of the new rules.

There’s a lot of misunderstanding and a lack of knowledge. And now that we are approaching that October 1 opening of these marketplaces, it’s important that people begin to get their questions answered.

____________________________________________________

KMUW hosted a live call-in show on Oct 9, 2013 to address questions about how the Affordable Care Act is going to affect individuals and businesses in Kansas. Check out our archive of those questions and answers from our experts to find out even more about how the Affordable Care Act is going to affect you.

Follow the on-going coverage of the Affordable Care Act with more reports from KMUW News and NPR.